The Financial Investigations Division (FID) says it has identified and received reports of a disturbing surge in fraudulent schemes targeting banking institutions and their clientele over the past 12 months.

The news comes as the agency charged two more people believed to be involved in a fraud targeting banks.

The FID says over the last year, 15 individuals have been charged for their involvement in the theft of bank customer credentials and personal data, which enabled the illicit use of the victims’ money, primarily through online transactions.

These individuals are currently before the courts.

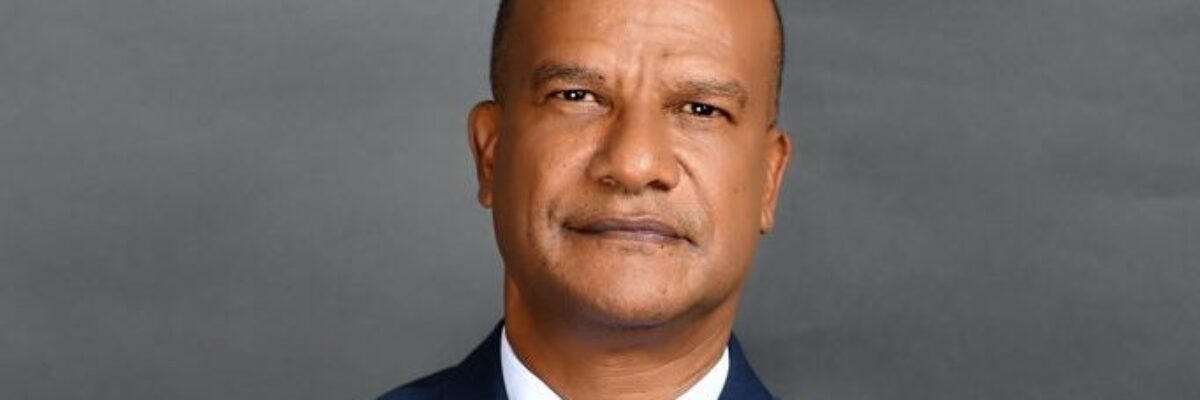

FID Principal Director of Investigations, Keith Darien, says the agency has allocated investigative resources to counter the surge in fraudulent activities, to identify and prosecute the involved parties.

Meantime, the FID noted that the two latest individuals arrested – Javina Baker and Daniel McNaughton – were nabbed in an early morning operation last Thursday, March 14.

The operation was conducted by a team from the FID, along with officers from the Counter Terrorism and Organized Crime Investigation branch (C-TOC) and the St. Andrew South police division.

The FID says the team of 18 officers focused on two residences, located on Delmonte Avenue and Calladium Crescent, in Kingston 11.

During the operation multiple cellular phones were seized and are currently undergoing forensic analysis.

Baker and McNaughton were detained and escorted to the Olympic Gardens police station where they were interviewed in the presence of a lawyer, and then charged.

Baker is facing charges of conspiracy to defraud, unauthorized access to computer data, and making a device available for committing an offence.

McNaughton is facing charges of simple larceny, conspiracy to defraud, possession of criminal property, engaging in a transaction involving criminal property, unauthorized access to computer data, and making a device available for committing an offence.

Several other persons suspected to be involved in the fraudulent scheme are being investigated by the FID.